Page 438 - F2 Integrated Workbook STUDENT 2019

P. 438

Chapter 19

Chapter 7

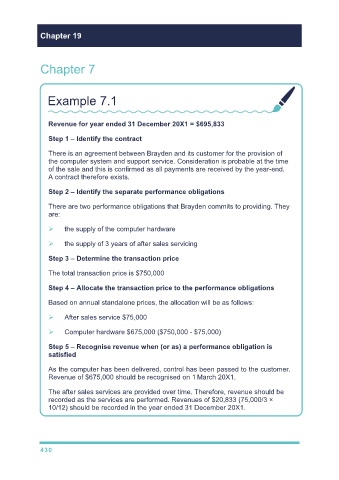

Example 7.1

Revenue for year ended 31 December 20X1 = $695,833

Step 1 – Identify the contract

There is an agreement between Brayden and its customer for the provision of

the computer system and support service. Consideration is probable at the time

of the sale and this is confirmed as all payments are received by the year-end.

A contract therefore exists.

Step 2 – Identify the separate performance obligations

There are two performance obligations that Brayden commits to providing. They

are:

the supply of the computer hardware

the supply of 3 years of after sales servicing

Step 3 – Determine the transaction price

The total transaction price is $750,000

Step 4 – Allocate the transaction price to the performance obligations

Based on annual standalone prices, the allocation will be as follows:

After sales service $75,000

Computer hardware $675,000 ($750,000 - $75,000)

Step 5 – Recognise revenue when (or as) a performance obligation is

satisfied

As the computer has been delivered, control has been passed to the customer.

Revenue of $675,000 should be recognised on 1 March 20X1.

The after sales services are provided over time. Therefore, revenue should be

recorded as the services are performed. Revenues of $20,833 (75,000/3 ×

10/12) should be recorded in the year ended 31 December 20X1.

430