Page 12 - PowerPoint Presentation

P. 12

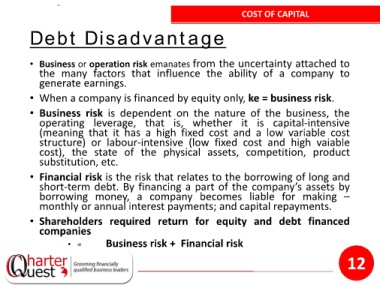

COST OF CAPITAL

Debt Disadvantage

• Business or operation risk emanates from the uncertainty attached to

the many factors that influence the ability of a company to

generate earnings.

• When a company is financed by equity only, ke = business risk.

• Business risk is dependent on the nature of the business, the

operating leverage, that is, whether it is capital-intensive

(meaning that it has a high fixed cost and a low variable cost

structure) or labour-intensive (low fixed cost and high vaiable

cost), the state of the physical assets, competition, product

substitution, etc.

• Financial risk is the risk that relates to the borrowing of long and

short-term debt. By financing a part of the company’s assets by

borrowing money, a company becomes liable for making –

monthly or annual interest payments; and capital repayments.

• Shareholders required return for equity and debt financed

companies

• = Business risk + Financial risk

12