Page 17 - PowerPoint Presentation

P. 17

COST OF CAPITAL

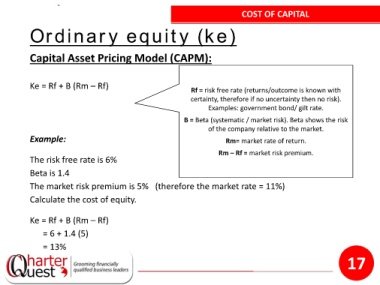

Ordinary equity (ke)

Capital Asset Pricing Model (CAPM):

Ke = Rf + B (Rm – Rf) Rf = risk free rate (returns/outcome is known with

certainty, therefore if no uncertainty then no risk).

Examples: government bond/ gilt rate.

B = Beta (systematic / market risk). Beta shows the risk

of the company relative to the market.

Example: Rm= market rate of return.

Rm – Rf = market risk premium.

The risk free rate is 6%

Beta is 1.4

The market risk premium is 5% (therefore the market rate = 11%)

Calculate the cost of equity.

Ke = Rf + B (Rm – Rf)

= 6 + 1.4 (5)

= 13%

17