Page 15 - PowerPoint Presentation

P. 15

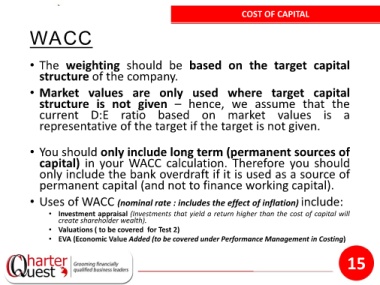

COST OF CAPITAL

WACC

• The weighting should be based on the target capital

structure of the company.

• Market values are only used where target capital

structure is not given – hence, we assume that the

current D:E ratio based on market values is a

representative of the target if the target is not given.

• You should only include long term (permanent sources of

capital) in your WACC calculation. Therefore you should

only include the bank overdraft if it is used as a source of

permanent capital (and not to finance working capital).

• Uses of WACC (nominal rate : includes the effect of inflation) include:

• Investment appraisal (Investments that yield a return higher than the cost of capital will

create shareholder wealth).

• Valuations ( to be covered for Test 2)

• EVA (Economic Value Added (to be covered under Performance Management in Costing)

15