Page 33 - PowerPoint Presentation

P. 33

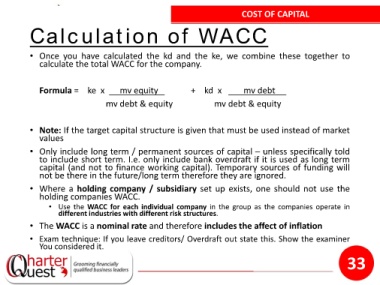

COST OF CAPITAL

Calculation of WACC

• Once you have calculated the kd and the ke, we combine these together to

calculate the total WACC for the company.

Formula = ke x mv equity + kd x mv debt .

mv debt & equity mv debt & equity

• Note: If the target capital structure is given that must be used instead of market

values

• Only include long term / permanent sources of capital – unless specifically told

to include short term. I.e. only include bank overdraft if it is used as long term

capital (and not to finance working capital). Temporary sources of funding will

not be there in the future/long term therefore they are ignored.

• Where a holding company / subsidiary set up exists, one should not use the

holding companies WACC.

• Use the WACC for each individual company in the group as the companies operate in

different industries with different risk structures.

• The WACC is a nominal rate and therefore includes the affect of inflation

• Exam technique: If you leave creditors/ Overdraft out state this. Show the examiner

You considered it.

33