Page 37 - PowerPoint Presentation

P. 37

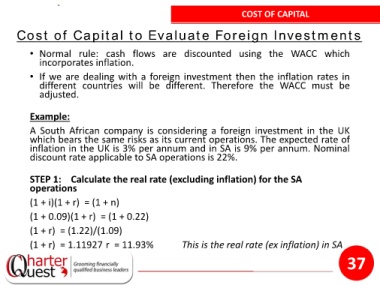

COST OF CAPITAL

Cost of Capital to Evaluate Foreign Investments

• Normal rule: cash flows are discounted using the WACC which

incorporates inflation.

• If we are dealing with a foreign investment then the inflation rates in

different countries will be different. Therefore the WACC must be

adjusted.

Example:

A South African company is considering a foreign investment in the UK

which bears the same risks as its current operations. The expected rate of

inflation in the UK is 3% per annum and in SA is 9% per annum. Nominal

discount rate applicable to SA operations is 22%.

STEP 1: Calculate the real rate (excluding inflation) for the SA

operations

(1 + i)(1 + r) = (1 + n)

(1 + 0.09)(1 + r) = (1 + 0.22)

(1 + r) = (1.22)/(1.09)

(1 + r) = 1.11927 r = 11.93% This is the real rate (ex inflation) in SA

37