Page 36 - PowerPoint Presentation

P. 36

COST OF CAPITAL

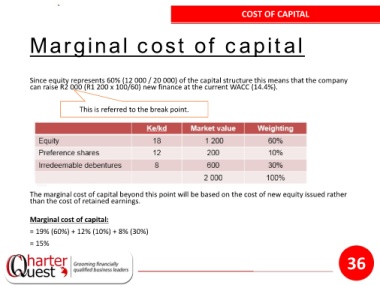

Marginal cost of capital

Since equity represents 60% (12 000 / 20 000) of the capital structure this means that the company

can raise R2 000 (R1 200 x 100/60) new finance at the current WACC (14.4%).

This is referred to the break point.

The marginal cost of capital beyond this point will be based on the cost of new equity issued rather

than the cost of retained earnings.

Marginal cost of capital:

= 19% (60%) + 12% (10%) + 8% (30%)

= 15%

36