Page 14 - PowerPoint Presentation

P. 14

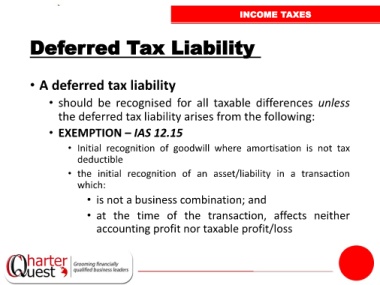

INCOME TAXES

Deferred Tax Liability

• A deferred tax liability

• should be recognised for all taxable differences unless

the deferred tax liability arises from the following:

• EXEMPTION – IAS 12.15

• Initial recognition of goodwill where amortisation is not tax

deductible

• the initial recognition of an asset/liability in a transaction

which:

• is not a business combination; and

• at the time of the transaction, affects neither

accounting profit nor taxable profit/loss