Page 16 - PowerPoint Presentation

P. 16

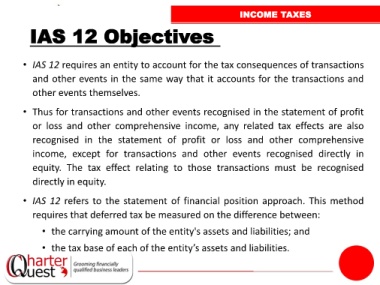

INCOME TAXES

IAS 12 Objectives

• IAS 12 requires an entity to account for the tax consequences of transactions

and other events in the same way that it accounts for the transactions and

other events themselves.

• Thus for transactions and other events recognised in the statement of profit

or loss and other comprehensive income, any related tax effects are also

recognised in the statement of profit or loss and other comprehensive

income, except for transactions and other events recognised directly in

equity. The tax effect relating to those transactions must be recognised

directly in equity.

• IAS 12 refers to the statement of financial position approach. This method

requires that deferred tax be measured on the difference between:

• the carrying amount of the entity's assets and liabilities; and

• the tax base of each of the entity’s assets and liabilities.