Page 15 - PowerPoint Presentation

P. 15

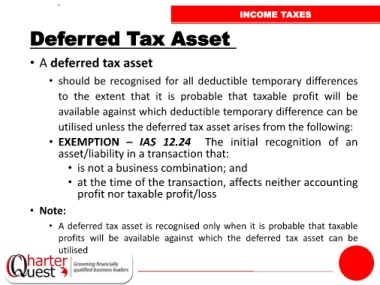

INCOME TAXES

Deferred Tax Asset

• A deferred tax asset

• should be recognised for all deductible temporary differences

to the extent that it is probable that taxable profit will be

available against which deductible temporary difference can be

utilised unless the deferred tax asset arises from the following:

• EXEMPTION – IAS 12.24 The initial recognition of an

asset/liability in a transaction that:

• is not a business combination; and

• at the time of the transaction, affects neither accounting

profit nor taxable profit/loss

• Note:

• A deferred tax asset is recognised only when it is probable that taxable

profits will be available against which the deferred tax asset can be

utilised