Page 19 - PowerPoint Presentation

P. 19

INCOME TAXES

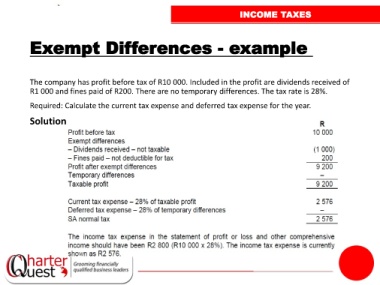

Exempt Differences - example

The company has profit before tax of R10 000. Included in the profit are dividends received of

R1 000 and fines paid of R200. There are no temporary differences. The tax rate is 28%.

Required: Calculate the current tax expense and deferred tax expense for the year.

Solution