Page 35 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 35

LOS 35.e: Describe the process of calibrating a READING 35: THE ARBITRAGE-FREE VALUATION FRAMEWORK

binomial interest rate tree to match a specific

term structure.

MODULE 35.1: BINOMIAL TREES, PART 1

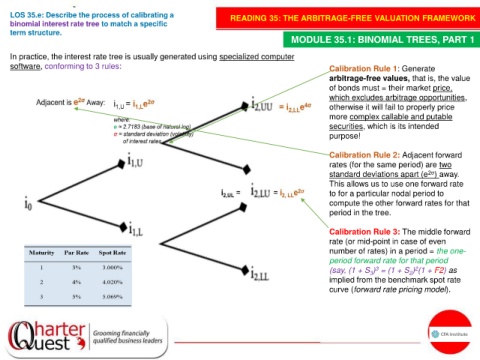

In practice, the interest rate tree is usually generated using specialized computer

software, conforming to 3 rules: Calibration Rule 1: Generate

arbitrage-free values, that is, the value

of bonds must = their market price,

which excludes arbitrage opportunities,

otherwise it will fail to properly price

more complex callable and putable

securities, which is its intended

purpose!

Calibration Rule 2: Adjacent forward

rates (for the same period) are two

2σ

standard deviations apart (e ) away.

This allows us to use one forward rate

to for a particular nodal period to

compute the other forward rates for that

period in the tree.

Calibration Rule 3: The middle forward

rate (or mid-point in case of even

number of rates) in a period = the one-

period forward rate for that period

3

2

(say, (1 + S ) = (1 + S ) (1 + F2) as

2

3

implied from the benchmark spot rate

curve (forward rate pricing model).