Page 30 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 30

LOS 34.m: Explain the maturity structure of yield READING 34: THE TERM STRUCTURE AND

volatilities and their effect on price volatility. INTEREST RATE DYNAMICS

MODULE 34.5: TERM STRUCTURE THEORY

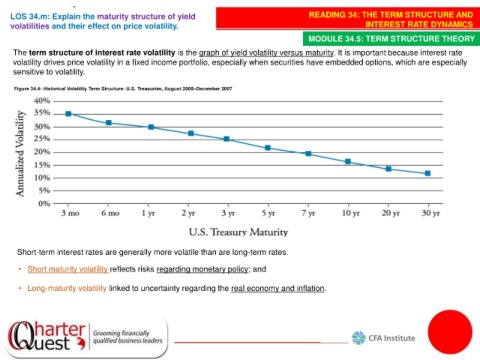

The term structure of interest rate volatility is the graph of yield volatility versus maturity. It is important because interest rate

volatility drives price volatility in a fixed income portfolio, especially when securities have embedded options, which are especially

sensitive to volatility.

Short-term interest rates are generally more volatile than are long-term rates.

• Short maturity volatility reflects risks regarding monetary policy; and

• Long-maturity volatility linked to uncertainty regarding the real economy and inflation.