Page 27 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 27

LOS 34.l: Explain how a bond’s exposure to READING 34: THE TERM STRUCTURE AND

each of the factors driving the yield curve can INTEREST RATE DYNAMICS

be measured and how these exposures can be MODULE 34.6: INTEREST RATE MODELS

used to manage yield curve risks.

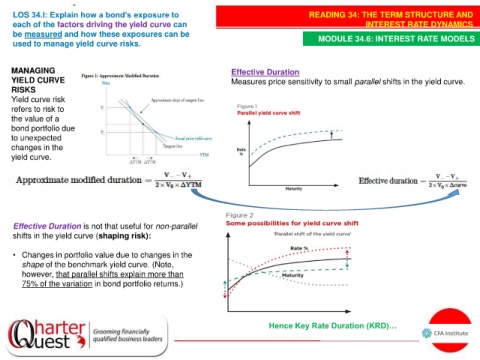

MANAGING Effective Duration

YIELD CURVE Measures price sensitivity to small parallel shifts in the yield curve.

RISKS

Yield curve risk

refers to risk to

the value of a

bond portfolio due

to unexpected

changes in the

yield curve.

Effective Duration is not that useful for non-parallel

shifts in the yield curve (shaping risk):

• Changes in portfolio value due to changes in the

shape of the benchmark yield curve. (Note,

however, that parallel shifts explain more than

75% of the variation in bond portfolio returns.)

Hence Key Rate Duration (KRD)…