Page 23 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 23

LOS 34.k: Describe modern term structure READING 34: THE TERM STRUCTURE AND

models and how they are used. INTEREST RATE DYNAMICS

dr = a(b − r)dt + σdz MODULE 34.6: INTEREST RATE MODELS

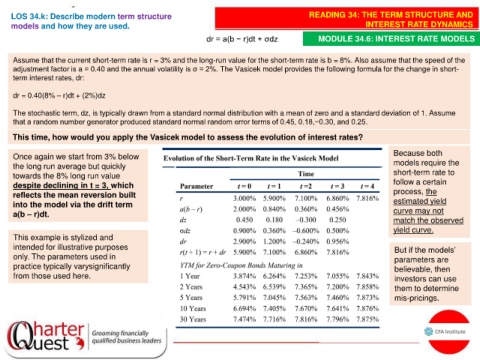

Assume that the current short-term rate is r = 3% and the long-run value for the short-term rate is b = 8%. Also assume that the speed of the

adjustment factor is a = 0.40 and the annual volatility is σ = 2%. The Vasicek model provides the following formula for the change in short-

term interest rates, dr:

dr = 0.40(8% – r)dt + (2%)dz

The stochastic term, dz, is typically drawn from a standard normal distribution with a mean of zero and a standard deviation of 1. Assume

that a random number generator produced standard normal random error terms of 0.45, 0.18,−0.30, and 0.25.

This time, how would you apply the Vasicek model to assess the evolution of interest rates?

Once again we start from 3% below Because both

the long run average but quickly models require the

towards the 8% long run value short-term rate to

despite declining in t = 3, which follow a certain

reflects the mean reversion built process, the

into the model via the drift term estimated yield

a(b – r)dt. curve may not

match the observed

yield curve.

This example is stylized and

intended for illustrative purposes But if the models’

only. The parameters used in parameters are

practice typically varysignificantly believable, then

from those used here. investors can use

them to determine

mis-pricings.