Page 24 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 24

LOS 34.k: Describe modern term structure READING 34: THE TERM STRUCTURE AND

models and how they are used. INTEREST RATE DYNAMICS

MODULE 34.6: INTEREST RATE MODELS

Arbitrage-Free Models

These begin with the assumption that bonds trading in the market are correctly priced, and the model is calibrated to value such

bonds consistent with their market price (hence the “arbitrage-free” label).

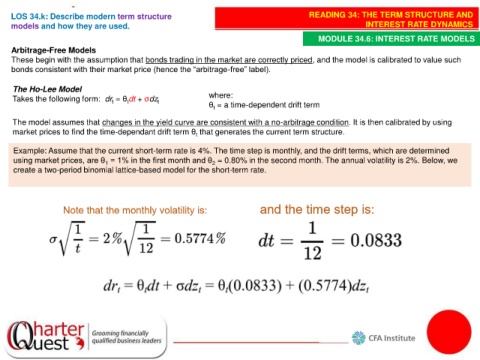

The Ho-Lee Model

Takes the following form: dr = θ dt + σdz where:

t

t

t

θ = a time-dependent drift term

t

The model assumes that changes in the yield curve are consistent with a no-arbitrage condition. It is then calibrated by using

market prices to find the time-dependant drift term θ that generates the current term structure.

t

Example: Assume that the current short-term rate is 4%. The time step is monthly, and the drift terms, which are determined

using market prices, are θ = 1% in the first month and θ = 0.80% in the second month. The annual volatility is 2%. Below, we

2

1

create a two-period binomial lattice-based model for the short-term rate.