Page 21 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 21

LOS 34.k: Describe modern term structure READING 34: THE TERM STRUCTURE AND

models and how they are used. INTEREST RATE DYNAMICS

MODULE 34.6: INTEREST RATE MODELS

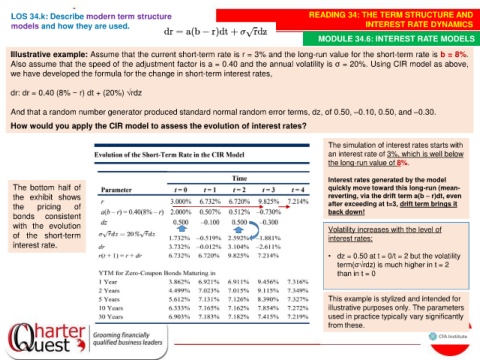

Illustrative example: Assume that the current short-term rate is r = 3% and the long-run value for the short-term rate is b = 8%.

Also assume that the speed of the adjustment factor is a = 0.40 and the annual volatility is σ = 20%. Using CIR model as above,

we have developed the formula for the change in short-term interest rates,

dr: dr = 0.40 (8% − r) dt + (20%) √rdz

And that a random number generator produced standard normal random error terms, dz, of 0.50, –0.10, 0.50, and –0.30.

How would you apply the CIR model to assess the evolution of interest rates?

The simulation of interest rates starts with

an interest rate of 3%, which is well below

the long-run value of 8%.

Interest rates generated by the model

The bottom half of quickly move toward this long-run (mean-

the exhibit shows reverting, via the drift term a(b – r)dt, even

the pricing of after exceeding at t=3, drift term brings it

back down!

bonds consistent

with the evolution Volatility increases with the level of

of the short-term interest rates:

interest rate.

• dz = 0.50 at t = 0/t = 2 but the volatility

term(σ√rdz) is much higher in t = 2

than in t = 0

This example is stylized and intended for

illustrative purposes only. The parameters

used in practice typically vary significantly

from these.