Page 16 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 16

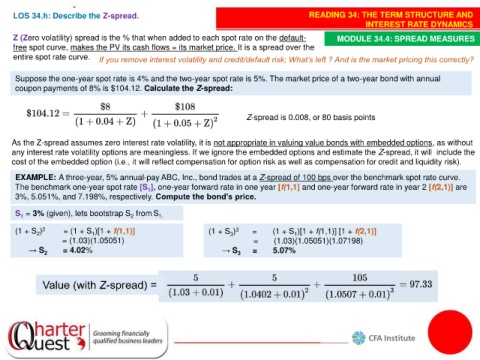

LOS 34.h: Describe the Z-spread. READING 34: THE TERM STRUCTURE AND

INTEREST RATE DYNAMICS

Z (Zero volatility) spread is the % that when added to each spot rate on the default- MODULE 34.4: SPREAD MEASURES

free spot curve, makes the PV its cash flows = its market price. It is a spread over the

entire spot rate curve. If you remove interest volatility and credit/default risk; What’s left ? And is the market pricing this correctly?

Suppose the one-year spot rate is 4% and the two-year spot rate is 5%. The market price of a two-year bond with annual

coupon payments of 8% is $104.12. Calculate the Z-spread:

Z-spread is 0.008, or 80 basis points

As the Z-spread assumes zero interest rate volatility, it is not appropriate in valuing value bonds with embedded options, as without

any interest rate volatility options are meaningless. If we ignore the embedded options and estimate the Z-spread, it will include the

cost of the embedded option (i.e., it will reflect compensation for option risk as well as compensation for credit and liquidity risk).

EXAMPLE: A three-year, 5% annual-pay ABC, Inc., bond trades at a Z-spread of 100 bps over the benchmark spot rate curve.

The benchmark one-year spot rate [S ], one-year forward rate in one year [f(1,1] and one-year forward rate in year 2 [f(2,1)] are

1

3%, 5.051%, and 7.198%, respectively. Compute the bond’s price.

S = 3% (given), lets bootstrap S from S 1.

2

1

(1 + S ) 2 = (1 + S )[1 + f(1,1)] (1 + S ) 3 = (1 + S )[1 + f(1,1)] [1 + f(2,1)]

3

1

1

2

= (1.03)(1.05051) = (1.03)(1.05051)(1.07198)

→ S 2 = 4.02% → S 3 = 5.07%