Page 15 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 15

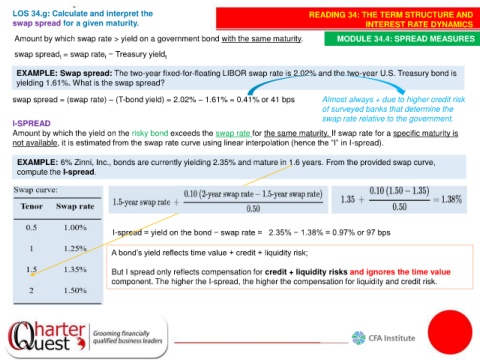

LOS 34.g: Calculate and interpret the READING 34: THE TERM STRUCTURE AND

swap spread for a given maturity. INTEREST RATE DYNAMICS

Amount by which swap rate > yield on a government bond with the same maturity. MODULE 34.4: SPREAD MEASURES

swap spread = swap rate − Treasury yield t

t

t

EXAMPLE: Swap spread: The two-year fixed-for-floating LIBOR swap rate is 2.02% and the two-year U.S. Treasury bond is

yielding 1.61%. What is the swap spread?

swap spread = (swap rate) – (T-bond yield) = 2.02% – 1.61% = 0.41% or 41 bps Almost always + due to higher credit risk

of surveyed banks that determine the

swap rate relative to the government.

I-SPREAD

Amount by which the yield on the risky bond exceeds the swap rate for the same maturity. If swap rate for a specific maturity is

not available, it is estimated from the swap rate curve using linear interpolation (hence the “I” in I-spread).

EXAMPLE: 6% Zinni, Inc., bonds are currently yielding 2.35% and mature in 1.6 years. From the provided swap curve,

compute the I-spread.

I-spread = yield on the bond − swap rate = 2.35% − 1.38% = 0.97% or 97 bps

A bond’s yield reflects time value + credit + liquidity risk;

But I spread only reflects compensation for credit + liquidity risks and ignores the time value

component. The higher the I-spread, the higher the compensation for liquidity and credit risk.