Page 12 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 12

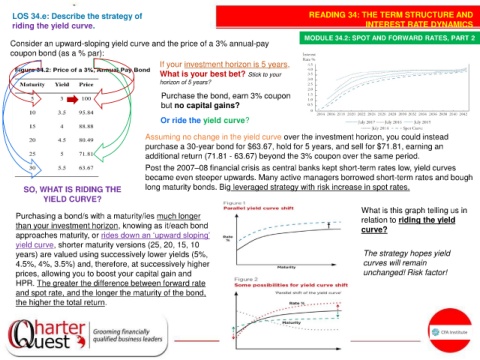

LOS 34.e: Describe the strategy of READING 34: THE TERM STRUCTURE AND

riding the yield curve. INTEREST RATE DYNAMICS

MODULE 34.2: SPOT AND FORWARD RATES, PART 2

Consider an upward-sloping yield curve and the price of a 3% annual-pay

coupon bond (as a % par):

If your investment horizon is 5 years,

What is your best bet? Stick to your

horizon of 5 years?

Purchase the bond, earn 3% coupon

but no capital gains?

Or ride the yield curve?

Assuming no change in the yield curve over the investment horizon, you could instead

purchase a 30-year bond for $63.67, hold for 5 years, and sell for $71.81, earning an

additional return (71.81 - 63.67) beyond the 3% coupon over the same period.

Post the 2007–08 financial crisis as central banks kept short-term rates low, yield curves

became even steeper upwards. Many active managers borrowed short-term rates and bough

SO, WHAT IS RIDING THE long maturity bonds. Big leveraged strategy with risk increase in spot rates.

YIELD CURVE?

What is this graph telling us in

Purchasing a bond/s with a maturity/ies much longer relation to riding the yield

than your investment horizon, knowing as it/each bond curve?

approaches maturity, or rides down an ‘upward sloping’

yield curve, shorter maturity versions (25, 20, 15, 10

years) are valued using successively lower yields (5%, The strategy hopes yield

4.5%, 4%, 3.5%) and, therefore, at successively higher curves will remain

prices, allowing you to boost your capital gain and unchanged! Risk factor!

HPR. The greater the difference between forward rate

and spot rate, and the longer the maturity of the bond,

the higher the total return.