Page 8 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 8

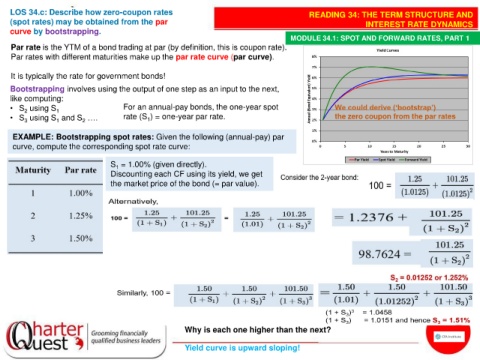

LOS 34.c: Describe how zero-coupon rates READING 34: THE TERM STRUCTURE AND

(spot rates) may be obtained from the par INTEREST RATE DYNAMICS

curve by bootstrapping.

MODULE 34.1: SPOT AND FORWARD RATES, PART 1

Par rate is the YTM of a bond trading at par (by definition, this is coupon rate).

Par rates with different maturities make up the par rate curve (par curve).

It is typically the rate for government bonds!

Bootstrapping involves using the output of one step as an input to the next,

like computing:

• S using S 1 For an annual-pay bonds, the one-year spot We could derive (‘bootstrap’)

2

• S using S and S …. rate (S ) = one-year par rate. the zero coupon from the par rates

1

2

1

3

EXAMPLE: Bootstrapping spot rates: Given the following (annual-pay) par

curve, compute the corresponding spot rate curve:

S = 1.00% (given directly).

1

Discounting each CF using its yield, we get

the market price of the bond (= par value).

Why is each one higher than the next?

Yield curve is upward sloping!