Page 20 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 20

LOS 34.k: Describe modern term structure READING 34: THE TERM STRUCTURE AND

models and how they are used. INTEREST RATE DYNAMICS

MODULE 34.6: INTEREST RATE MODELS

MODERN TERM STRUCTURE MODELS

Attempt to capture the statistical properties of interest rates movements and provide us with quantitatively precise descriptions of

how interest rates will change.

Equilibrium Term Structure Models: Driven by fundamental economic variables (C+I+G=X-M) that drive interest rates:

• Cox-Ingersoll-Ross (CIR) model and

• Vasicek Model.

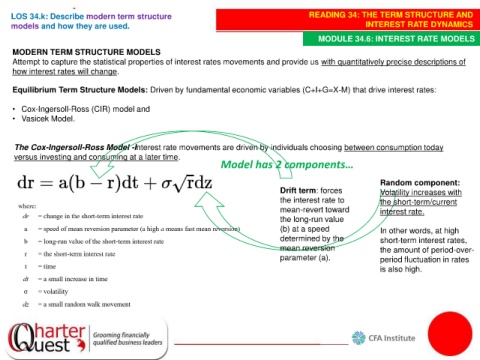

The Cox-Ingersoll-Ross Model -Interest rate movements are driven by individuals choosing between consumption today

versus investing and consuming at a later time.

Model has 2 components…

Random component:

Drift term: forces Volatility increases with

the interest rate to the short-term/current

mean-revert toward interest rate.

the long-run value

(b) at a speed In other words, at high

determined by the short-term interest rates,

mean reversion the amount of period-over-

parameter (a). period fluctuation in rates

is also high.