Page 38 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 38

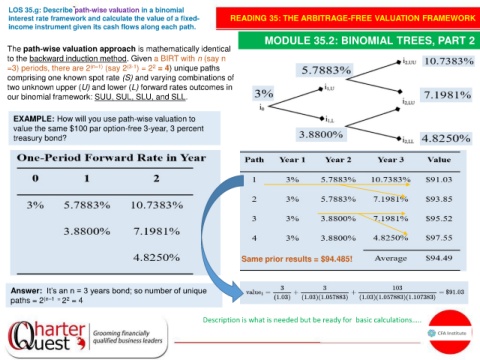

LOS 35.g: Describe path-wise valuation in a binomial

interest rate framework and calculate the value of a fixed- READING 35: THE ARBITRAGE-FREE VALUATION FRAMEWORK

income instrument given its cash flows along each path.

MODULE 35.2: BINOMIAL TREES, PART 2

The path-wise valuation approach is mathematically identical

to the backward induction method. Given a BIRT with n (say n

2

=3) periods, there are 2 (n–1) (say 2 (3-1 ) = 2 = 4) unique paths

comprising one known spot rate (S) and varying combinations of

two unknown upper (U) and lower (L) forward rates outcomes in

our binomial framework: SUU, SUL, SLU, and SLL.

EXAMPLE: How will you use path-wise valuation to

value the same $100 par option-free 3-year, 3 percent

treasury bond?

Same prior results = $94.485!

Answer: It’s an n = 3 years bond; so number of unique

paths = 2 (n–1 = 2

2 = 4

Description is what is needed but be ready for basic calculations…..