Page 41 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 41

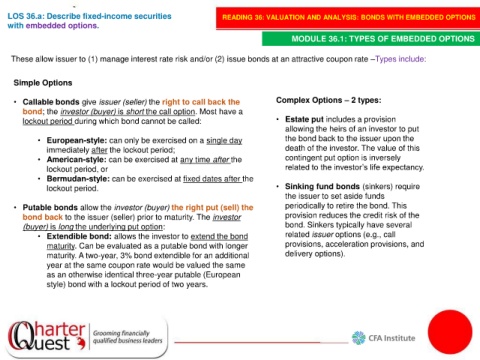

LOS 36.a: Describe fixed-income securities READING 36: VALUATION AND ANALYSIS: BONDS WITH EMBEDDED OPTIONS

with embedded options.

MODULE 36.1: TYPES OF EMBEDDED OPTIONS

These allow issuer to (1) manage interest rate risk and/or (2) issue bonds at an attractive coupon rate –Types include:

Simple Options

• Callable bonds give issuer (seller) the right to call back the Complex Options – 2 types:

bond; the investor (buyer) is short the call option. Most have a

lockout period during which bond cannot be called: • Estate put includes a provision

allowing the heirs of an investor to put

• European-style: can only be exercised on a single day the bond back to the issuer upon the

immediately after the lockout period; death of the investor. The value of this

• American-style: can be exercised at any time after the contingent put option is inversely

lockout period, or related to the investor’s life expectancy.

• Bermudan-style: can be exercised at fixed dates after the

lockout period. • Sinking fund bonds (sinkers) require

the issuer to set aside funds

• Putable bonds allow the investor (buyer) the right put (sell) the periodically to retire the bond. This

bond back to the issuer (seller) prior to maturity. The investor provision reduces the credit risk of the

(buyer) is long the underlying put option: bond. Sinkers typically have several

• Extendible bond: allows the investor to extend the bond related issuer options (e.g., call

maturity. Can be evaluated as a putable bond with longer provisions, acceleration provisions, and

maturity. A two-year, 3% bond extendible for an additional delivery options).

year at the same coupon rate would be valued the same

as an otherwise identical three-year putable (European

style) bond with a lockout period of two years.