Page 46 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 46

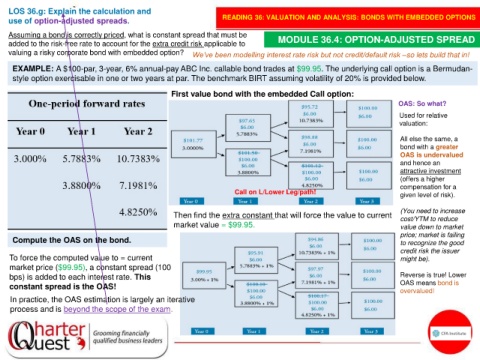

LOS 36.g: Explain the calculation and

use of option-adjusted spreads. READING 36: VALUATION AND ANALYSIS: BONDS WITH EMBEDDED OPTIONS

Assuming a bond is correctly priced, what is constant spread that must be MODULE 36.4: OPTION-ADJUSTED SPREAD

added to the risk-free rate to account for the extra credit risk applicable to

valuing a risky corporate bond with embedded option? We’ve been modelling interest rate risk but not credit/default risk –so lets build that in!

EXAMPLE: A $100-par, 3-year, 6% annual-pay ABC Inc. callable bond trades at $99.95. The underlying call option is a Bermudan-

style option exercisable in one or two years at par. The benchmark BIRT assuming volatility of 20% is provided below.

First value bond with the embedded Call option:

OAS: So what?

Used for relative

valuation:

All else the same, a

bond with a greater

OAS is undervalued

and hence an

attractive investment

(offers a higher

compensation for a

Call on L/Lower Leg/path!

given level of risk).

(You need to increase

Then find the extra constant that will force the value to current cost/YTM to reduce

market value = $99.95. value down to market

price; market is failing

Compute the OAS on the bond. to recognize the good

credit risk the issuer

To force the computed value to = current might be).

market price ($99.95), a constant spread (100

bps) is added to each interest rate. This Reverse is true! Lower

constant spread is the OAS! OAS means bond is

overvalued!

In practice, the OAS estimation is largely an iterative

process and is beyond the scope of the exam.