Page 44 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 44

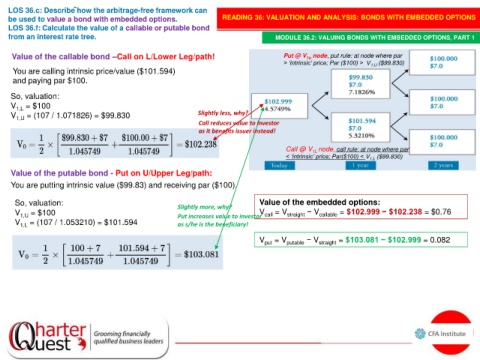

LOS 36.c: Describe how the arbitrage-free framework can

be used to value a bond with embedded options. READING 36: VALUATION AND ANALYSIS: BONDS WITH EMBEDDED OPTIONS

LOS 36.f: Calculate the value of a callable or putable bond

from an interest rate tree. MODULE 36.2: VALUING BONDS WITH EMBEDDED OPTIONS, PART 1

Value of the callable bond –Call on L/Lower Leg/path! Put @ V 1u node, put rule: at node where par

> ‘intrinsic’ price; Par ($100) > V 1,U ($99.830)

You are calling intrinsic price/value ($101.594)

and paying par $100.

So, valuation:

V 1,L = $100

V 1,U = (107 / 1.071826) = $99.830 Slightly less, why?

Call reduces value to investor

as it benefits issuer instead!

Call @ V node, call rule: at node where par

1L

< ‘intrinsic’ price; Par($100) < V 1,L ($99.830)

Value of the putable bond - Put on U/Upper Leg/path:

You are putting intrinsic value ($99.83) and receiving par ($100).

So, valuation: Slightly more, why? Value of the embedded options:

V

V 1,U = $100 Put increases value to investor call = V straight − V callable = $102.999 − $102.238 = $0.76

V 1,L = (107 / 1.053210) = $101.594 as s/he is the beneficiary!

V put = V putable − V straight = $103.081 − $102.999 = 0.082