Page 47 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 47

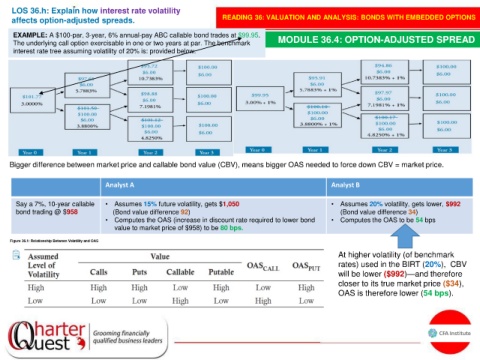

LOS 36.h: Explain how interest rate volatility

affects option-adjusted spreads. READING 36: VALUATION AND ANALYSIS: BONDS WITH EMBEDDED OPTIONS

EXAMPLE: A $100-par, 3-year, 6% annual-pay ABC callable bond trades at $99.95. MODULE 36.4: OPTION-ADJUSTED SPREAD

The underlying call option exercisable in one or two years at par. The benchmark

interest rate tree assuming volatility of 20% is: provided below.

Bigger difference between market price and callable bond value (CBV), means bigger OAS needed to force down CBV = market price.

Analyst A Analyst B

Say a 7%, 10-year callable • Assumes 15% future volatility, gets $1,050 • Assumes 20% volatility, gets lower, $992

bond trading @ $958 (Bond value difference 92) (Bond value difference 34)

• Computes the OAS (increase in discount rate required to lower bond • Computes the OAS to be 54 bps

value to market price of $958) to be 80 bps.

At higher volatility (of benchmark

rates) used in the BIRT (20%), CBV

will be lower ($992)—and therefore

closer to its true market price ($34),

OAS is therefore lower (54 bps).