Page 45 - FINAL CFA II SLIDES JUNE 2019 DAY 9

P. 45

LOS 36.d: Explain how interest rate volatility

affects the value of a callable or putable bond. READING 36: VALUATION AND ANALYSIS: BONDS WITH EMBEDDED OPTIONS

The higher the interest rate volatility (risk), the higher MODULE 36.3: VALUING BONDS WITH EMBEDDED OPTIONS, PART 2

the values of embedded call and put options.

For a straight bond, value is affected by changes in level of interest rates (capital gains) but not by changes interest rate volatility.

Why? Coupon is fixed, so any volatility only reflects via capital gains/losses. Different for bonds with embedded options though!

LOS 36.e: Explain how changes in the level and shape of the yield curve affect the value of a callable or putable bond.

Level of Interest Rates: The inverse (negative) relationship between interest rates and bond prices is well established: Why?

1. Increased (higher) interest rates means higher discount rates which reduces present values of bond cash inflows; or

2. Investors locked in fixed income may sell bonds (shifting to higher interest-earning securities). And vice versa!

Implication for value of call options?

Inverse relationship: Higher interest (discount) rate = lower bonds value (<

par). Issuer is unlikely to call back, hence lower call option value to issuer!

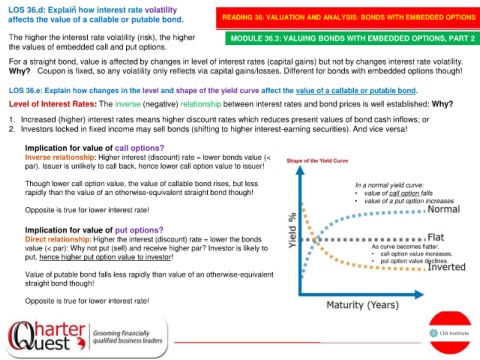

Though lower call option value, the value of callable bond rises, but less In a normal yield curve:

rapidly than the value of an otherwise-equivalent straight bond though! • value of call option falls

• value of a put option increases

Opposite is true for lower interest rate!

Implication for value of put options?

Direct relationship: Higher the interest (discount) rate = lower the bonds

value (< par): Why not put (sell) and receive higher par? Investor is likely to As curve becomes flatter,

put, hence higher put option value to investor! • call option value increases.

• put option value declines.

Value of putable bond falls less rapidly than value of an otherwise-equivalent

straight bond though!

Opposite is true for lower interest rate!