Page 3 - PowerPoint Presentation

P. 3

LOS 34.a: Describe relationships among spot rates, READING 34: THE TERM STRUCTURE AND

forward rates, yield to maturity, expected and realized INTEREST RATE DYNAMICS

returns on bonds, and the shape of the yield curve.

MODULE 34.1: SPOT AND FORWARD RATES, PART 1

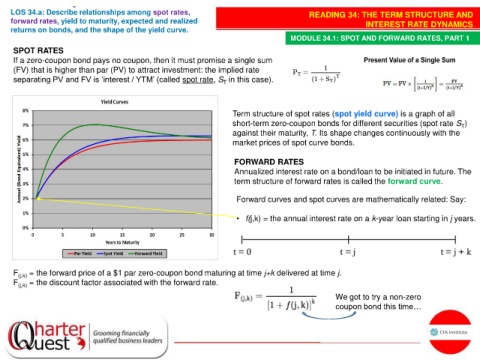

SPOT RATES

If a zero-coupon bond pays no coupon, then it must promise a single sum

(FV) that is higher than par (PV) to attract investment: the implied rate

separating PV and FV is ‘interest / YTM’ (called spot rate, S in this case).

T

Term structure of spot rates (spot yield curve) is a graph of all

short-term zero-coupon bonds for different securities (spot rate S )

T

against their maturity, T. Its shape changes continuously with the

market prices of spot curve bonds.

FORWARD RATES

Annualized interest rate on a bond/loan to be initiated in future. The

term structure of forward rates is called the forward curve.

Forward curves and spot curves are mathematically related: Say:

• f(j,k) = the annual interest rate on a k-year loan starting in j years.

F (j,k) = the forward price of a $1 par zero-coupon bond maturing at time j+k delivered at time j.

F (j,k) = the discount factor associated with the forward rate.

We got to try a non-zero

coupon bond this time…