Page 4 - PowerPoint Presentation

P. 4

LOS 34.a: Describe relationships among spot rates, READING 34: THE TERM STRUCTURE AND

forward rates, yield to maturity, expected and realized INTEREST RATE DYNAMICS

returns on bonds, and the shape of the yield curve.

MODULE 34.1: SPOT AND FORWARD RATES, PART 1

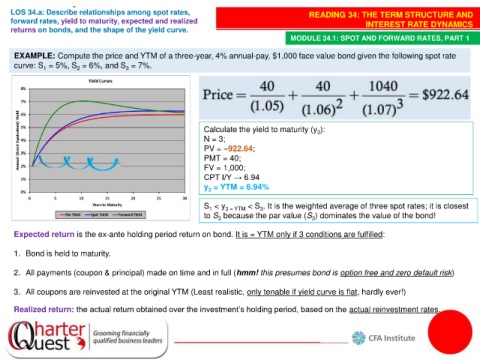

EXAMPLE: Compute the price and YTM of a three-year, 4% annual-pay, $1,000 face value bond given the following spot rate

curve: S = 5%, S = 6%, and S = 7%.

3

1

2

Calculate the yield to maturity (y ):

3

N = 3;

PV = –922.64;

PMT = 40;

FV = 1,000;

CPT I/Y → 6.94

y = YTM = 6.94%

3

S < y 3 = YTM < S . It is the weighted average of three spot rates; it is closest

1

3

to S because the par value (S ) dominates the value of the bond!

3

3

Expected return is the ex-ante holding period return on bond. It is = YTM only if 3 conditions are fulfilled:

1. Bond is held to maturity.

2. All payments (coupon & principal) made on time and in full (hmm! this presumes bond is option free and zero default risk)

3. All coupons are reinvested at the original YTM (Least realistic, only tenable if yield curve is flat, hardly ever!)

Realized return: the actual return obtained over the investment’s holding period, based on the actual reinvestment rates.