Page 7 - PowerPoint Presentation

P. 7

LOS 34.b: Describe the forward pricing and forward

rate models and calculate forward and spot prices READING 34: THE TERM STRUCTURE AND

and rates using those models. INTEREST RATE DYNAMICS

MODULE 34.1: SPOT AND FORWARD RATES, PART 1

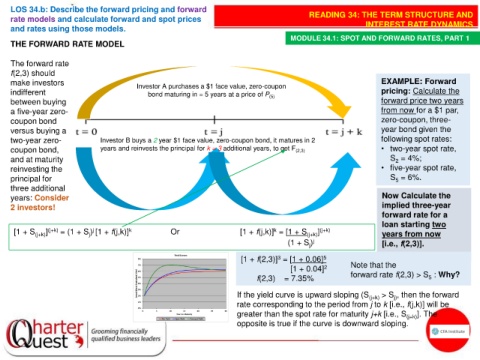

THE FORWARD RATE MODEL

The forward rate

f(2,3) should

make investors Investor A purchases a $1 face value, zero-coupon EXAMPLE: Forward

indifferent bond maturing in = 5 years at a price of P (5) pricing: Calculate the

between buying forward price two years

a five-year zero- from now for a $1 par,

coupon bond zero-coupon, three-

versus buying a year bond given the

two-year zero- Investor B buys a 2 year $1 face value, zero-coupon bond, it matures in 2 following spot rates:

coupon bond, years and reinvests the principal for k = 3 additional years, to get F (2,3) • two-year spot rate,

and at maturity S = 4%;

2

reinvesting the • five-year spot rate,

principal for S = 6%.

5

three additional

years: Consider Now Calculate the

2 investors! implied three-year

forward rate for a

loan starting two

k

j

[1 + S (j+k) ] (j+k) = (1 + S ) [1 + f(j,k)] k Or [1 + f(j,k)] = [1 + S (j+k) ] (j+k) years from now

j

(1 + S ) j [i.e., f(2,3)].

j

[1 + f(2,3)] = [1 + 0.06] 5

3

[1 + 0.04] 2 Note that the

f(2,3) = 7.35% forward rate f(2,3) > S : Why?

5

If the yield curve is upward sloping (S (j+k) > S , then the forward

j)

rate corresponding to the period from j to k [i.e., f(j,k)] will be

greater than the spot rate for maturity j+k [i.e., S (j+k) ]. The

opposite is true if the curve is downward sloping.