Page 10 - PowerPoint Presentation

P. 10

LOS 34.d: Describe the assumptions concerning the READING 34: THE TERM STRUCTURE AND

evolution of spot rates in relation to forward rates

implicit in active bond portfolio management. INTEREST RATE DYNAMICS

MODULE 34.2: SPOT AND FORWARD RATES, PART 2

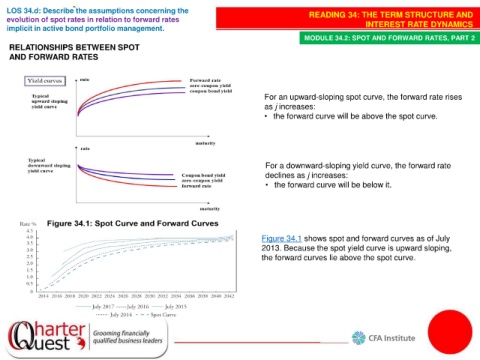

RELATIONSHIPS BETWEEN SPOT

AND FORWARD RATES

For an upward-sloping spot curve, the forward rate rises

as j increases:

• the forward curve will be above the spot curve.

For a downward-sloping yield curve, the forward rate

declines as j increases:

• the forward curve will be below it.

Figure 34.1 shows spot and forward curves as of July

2013. Because the spot yield curve is upward sloping,

the forward curves lie above the spot curve.