Page 14 - PowerPoint Presentation

P. 14

LOS 34.f: Explain the swap rate curve and why READING 34: THE TERM STRUCTURE AND

and how market participants use it in valuation. INTEREST RATE DYNAMICS

MODULE 34.3: THE SWAP RATE CURVE

THE SWAP RATE CURVE

The swap (fixed) rate is the paid by the party paying the fixed rate in order to receive the variable rate in a plain vanilla interest

rate swap. The swap rates curve represents different swap rates for swap instruments with different maturities.

Rather than government bond yield curve (GBYC), it is the preferred interest-rate benchmark for credit markets, as:

• It reflect the credit risk of commercial banks rather than the credit risk of governments.

• The swap market is not regulated by any government, allowing comparisons between countries (government bond

yield curves additionally reflect sovereign risk unique to each country);

• It has yield quotes at many maturities, while the U.S. GBYC has ‘on-the-run issues’ trading at few number of

maturities.

Unlike retail banks that may nonetheless use GBYC, wholesale banks and many others that manage interest rate risk with

swap contracts are more likely to use swap curves to value their assets and liabilities.

The LIBOR swap curve is arguably the most commonly used interest rate curve. This rate curve roughly reflects the default risk

of a commercial bank.

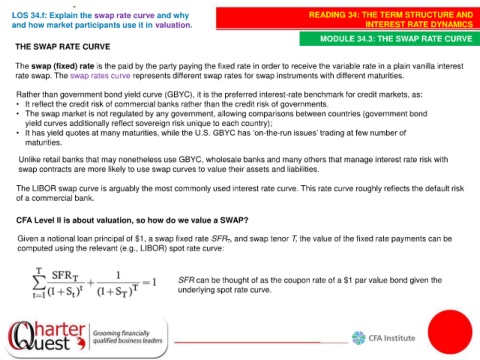

CFA Level II is about valuation, so how do we value a SWAP?

Given a notional loan principal of $1, a swap fixed rate SFR , and swap tenor T, the value of the fixed rate payments can be

T

computed using the relevant (e.g., LIBOR) spot rate curve:

SFR can be thought of as the coupon rate of a $1 par value bond given the

underlying spot rate curve.