Page 17 - PowerPoint Presentation

P. 17

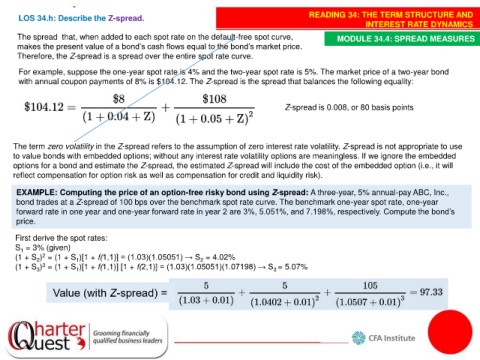

LOS 34.h: Describe the Z-spread. READING 34: THE TERM STRUCTURE AND

INTEREST RATE DYNAMICS

The spread that, when added to each spot rate on the default-free spot curve, MODULE 34.4: SPREAD MEASURES

makes the present value of a bond’s cash flows equal to the bond’s market price.

Therefore, the Z-spread is a spread over the entire spot rate curve.

For example, suppose the one-year spot rate is 4% and the two-year spot rate is 5%. The market price of a two-year bond

with annual coupon payments of 8% is $104.12. The Z-spread is the spread that balances the following equality:

Z-spread is 0.008, or 80 basis points

The term zero volatility in the Z-spread refers to the assumption of zero interest rate volatility. Z-spread is not appropriate to use

to value bonds with embedded options; without any interest rate volatility options are meaningless. If we ignore the embedded

options for a bond and estimate the Z-spread, the estimated Z-spread will include the cost of the embedded option (i.e., it will

reflect compensation for option risk as well as compensation for credit and liquidity risk).

EXAMPLE: Computing the price of an option-free risky bond using Z-spread: A three-year, 5% annual-pay ABC, Inc.,

bond trades at a Z-spread of 100 bps over the benchmark spot rate curve. The benchmark one-year spot rate, one-year

forward rate in one year and one-year forward rate in year 2 are 3%, 5.051%, and 7.198%, respectively. Compute the bond’s

price.

First derive the spot rates:

S = 3% (given)

1

2

(1 + S ) = (1 + S )[1 + f(1,1)] = (1.03)(1.05051) → S = 4.02%

1

2

2

(1 + S ) = (1 + S )[1 + f(1,1)] [1 + f(2,1)] = (1.03)(1.05051)(1.07198) → S = 5.07%

3

3

3

1