Page 19 - PowerPoint Presentation

P. 19

LOS 34.j: Explain traditional theories of the term READING 34: THE TERM STRUCTURE AND

structure of interest rates and describe the INTEREST RATE DYNAMICS

implications of each theory for forward rates and MODULE 34.5: TERM STRUCTURE THEORY

the shape of the yield curve.

Unbiased (Pure) Expectations Theory: An investor with a three-year investment horizon expects or would be indifferent

between investing in a three-year bond or in a five-year bond that will be sold two years prior to maturity.

In other words, forward rates are solely a function of expected future spot rates, and that every maturity strategy has the same

expected return over a given investment horizon.

The underlying principle is risk neutrality: Investors don’t demand a risk premium for maturity strategies that differ from their

investment horizon.

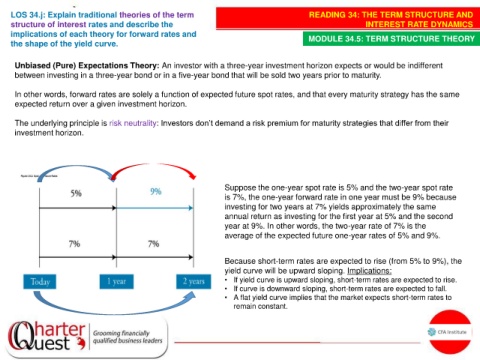

Suppose the one-year spot rate is 5% and the two-year spot rate

is 7%, the one-year forward rate in one year must be 9% because

investing for two years at 7% yields approximately the same

annual return as investing for the first year at 5% and the second

year at 9%. In other words, the two-year rate of 7% is the

average of the expected future one-year rates of 5% and 9%.

Because short-term rates are expected to rise (from 5% to 9%), the

yield curve will be upward sloping. Implications:

• If yield curve is upward sloping, short-term rates are expected to rise.

• If curve is downward sloping, short-term rates are expected to fall.

• A flat yield curve implies that the market expects short-term rates to

remain constant.