Page 23 - PowerPoint Presentation

P. 23

LOS 34.k: Describe modern term structure READING 34: THE TERM STRUCTURE AND

models and how they are used. INTEREST RATE DYNAMICS

MODULE 34.6: INTEREST RATE MODELS

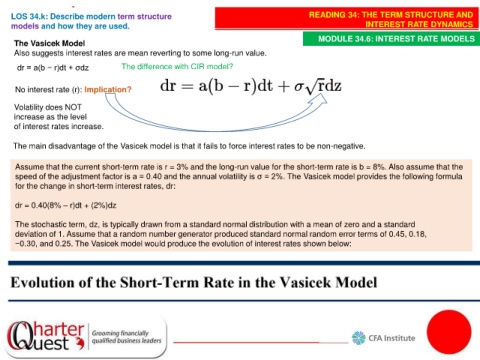

The Vasicek Model

Also suggests interest rates are mean reverting to some long-run value.

dr = a(b − r)dt + σdz The difference with CIR model?

No interest rate (r): Implication?

Volatility does NOT

increase as the level

of interest rates increase.

The main disadvantage of the Vasicek model is that it fails to force interest rates to be non-negative.

Assume that the current short-term rate is r = 3% and the long-run value for the short-term rate is b = 8%. Also assume that the

speed of the adjustment factor is a = 0.40 and the annual volatility is σ = 2%. The Vasicek model provides the following formula

for the change in short-term interest rates, dr:

dr = 0.40(8% – r)dt + (2%)dz

The stochastic term, dz, is typically drawn from a standard normal distribution with a mean of zero and a standard

deviation of 1. Assume that a random number generator produced standard normal random error terms of 0.45, 0.18,

−0.30, and 0.25. The Vasicek model would produce the evolution of interest rates shown below: