Page 25 - PowerPoint Presentation

P. 25

LOS 34.k: Describe modern term structure READING 34: THE TERM STRUCTURE AND

models and how they are used. INTEREST RATE DYNAMICS

MODULE 34.6: INTEREST RATE MODELS

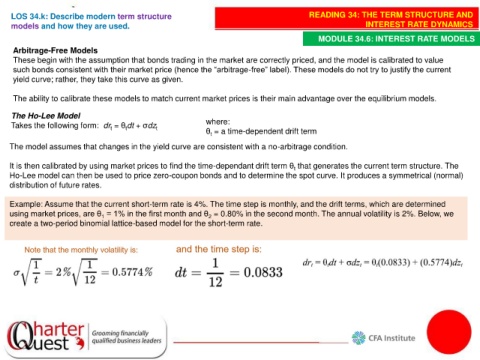

Arbitrage-Free Models

These begin with the assumption that bonds trading in the market are correctly priced, and the model is calibrated to value

such bonds consistent with their market price (hence the “arbitrage-free” label). These models do not try to justify the current

yield curve; rather, they take this curve as given.

The ability to calibrate these models to match current market prices is their main advantage over the equilibrium models.

The Ho-Lee Model

Takes the following form: dr = θ dt + σdz where:

t

t

t

θ = a time-dependent drift term

t

The model assumes that changes in the yield curve are consistent with a no-arbitrage condition.

It is then calibrated by using market prices to find the time-dependant drift term θ that generates the current term structure. The

t

Ho-Lee model can then be used to price zero-coupon bonds and to determine the spot curve. It produces a symmetrical (normal)

distribution of future rates.

Example: Assume that the current short-term rate is 4%. The time step is monthly, and the drift terms, which are determined

using market prices, are θ = 1% in the first month and θ = 0.80% in the second month. The annual volatility is 2%. Below, we

1

2

create a two-period binomial lattice-based model for the short-term rate.