Page 29 - PowerPoint Presentation

P. 29

LOS 34.l: Explain how a bond’s exposure to each of the

factors driving the yield curve can be measured and how these

exposures can be used to manage yield curve risks. Session Unit 16:

54. Understanding Fixed Income Risk and Return

REVIEW FROM CFA LEVEL 1

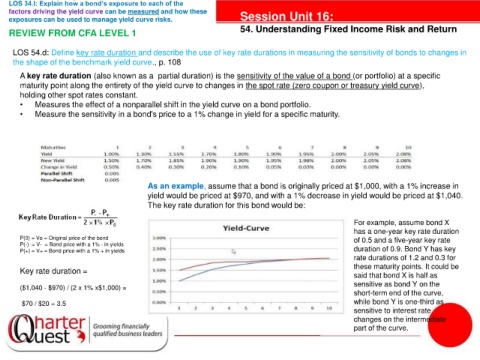

LOS 54.d: Define key rate duration and describe the use of key rate durations in measuring the sensitivity of bonds to changes in

the shape of the benchmark yield curve., p. 108

A key rate duration (also known as a partial duration) is the sensitivity of the value of a bond (or portfolio) at a specific

maturity point along the entirety of the yield curve to changes in the spot rate (zero coupon or treasury yield curve),

holding other spot rates constant.

• Measures the effect of a nonparallel shift in the yield curve on a bond portfolio.

• Measure the sensitivity in a bond's price to a 1% change in yield for a specific maturity.

tanties

As an example, assume that a bond is originally priced at $1,000, with a 1% increase in

yield would be priced at $970, and with a 1% decrease in yield would be priced at $1,040.

The key rate duration for this bond would be:

For example, assume bond X

has a one-year key rate duration

P(0) = Vo = Original price of the bond of 0.5 and a five-year key rate

P(-) = V- = Bond price with a 1% - in yields

P(+) = V+ = Bond price with a 1% + in yields duration of 0.9. Bond Y has key

rate durations of 1.2 and 0.3 for

these maturity points. It could be

Key rate duration =

said that bond X is half as

sensitive as bond Y on the

($1,040 - $970) / (2 x 1% x$1,000) =

short-term end of the curve,

$70 / $20 = 3.5 while bond Y is one-third as

sensitive to interest rate

changes on the intermediate

part of the curve.