Page 33 - PowerPoint Presentation

P. 33

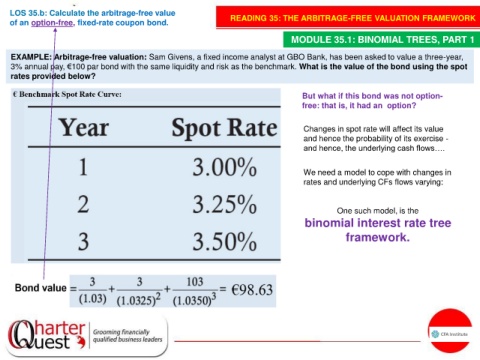

LOS 35.b: Calculate the arbitrage-free value

of an option-free, fixed-rate coupon bond. READING 35: THE ARBITRAGE-FREE VALUATION FRAMEWORK

MODULE 35.1: BINOMIAL TREES, PART 1

EXAMPLE: Arbitrage-free valuation: Sam Givens, a fixed income analyst at GBO Bank, has been asked to value a three-year,

3% annual pay, €100 par bond with the same liquidity and risk as the benchmark. What is the value of the bond using the spot

rates provided below?

But what if this bond was not option-

free: that is, it had an option?

Changes in spot rate will affect its value

and hence the probability of its exercise -

and hence, the underlying cash flows….

We need a model to cope with changes in

rates and underlying CFs flows varying:

One such model, is the

binomial interest rate tree

framework.