Page 32 - PowerPoint Presentation

P. 32

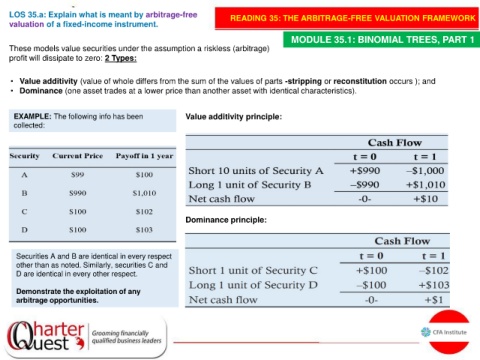

LOS 35.a: Explain what is meant by arbitrage-free READING 35: THE ARBITRAGE-FREE VALUATION FRAMEWORK

valuation of a fixed-income instrument.

MODULE 35.1: BINOMIAL TREES, PART 1

These models value securities under the assumption a riskless (arbitrage)

profit will dissipate to zero: 2 Types:

• Value additivity (value of whole differs from the sum of the values of parts -stripping or reconstitution occurs ); and

• Dominance (one asset trades at a lower price than another asset with identical characteristics).

EXAMPLE: The following info has been Value additivity principle:

collected:

Dominance principle:

Securities A and B are identical in every respect

other than as noted. Similarly, securities C and

D are identical in every other respect.

Demonstrate the exploitation of any

arbitrage opportunities.