Page 34 - PowerPoint Presentation

P. 34

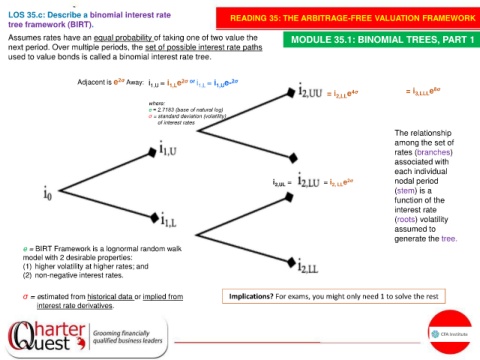

LOS 35.c: Describe a binomial interest rate READING 35: THE ARBITRAGE-FREE VALUATION FRAMEWORK

tree framework (BIRT).

Assumes rates have an equal probability of taking one of two value the MODULE 35.1: BINOMIAL TREES, PART 1

next period. Over multiple periods, the set of possible interest rate paths

used to value bonds is called a binomial interest rate tree.

Adjacent is e 2σ Away: i 1,U = i e 2σ or i 1,L = i 1,U e- 2σ

1,L

= i 2,LL e 4σ = i 3,LLL e 8σ

where:

e ≈ 2.7183 (base of natural log)

σ = standard deviation (volatility)

of interest rates

The relationship

among the set of

rates (branches)

associated with

each individual

i 2,UL = = i 2, LL e 2σ nodal period

(stem) is a

function of the

interest rate

(roots) volatility

assumed to

generate the tree.

e = BIRT Framework is a lognormal random walk

model with 2 desirable properties:

(1) higher volatility at higher rates; and

(2) non-negative interest rates.

σ = estimated from historical data or implied from Implications? For exams, you might only need 1 to solve the rest

interest rate derivatives.