Page 38 - PowerPoint Presentation

P. 38

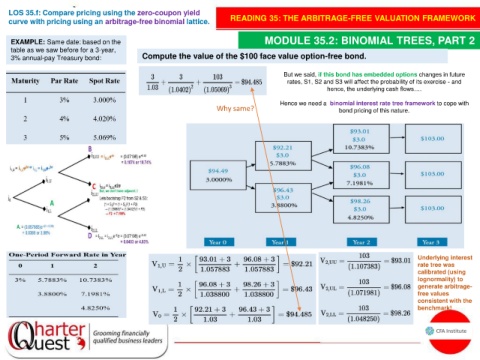

LOS 35.f: Compare pricing using the zero-coupon yield

curve with pricing using an arbitrage-free binomial lattice. READING 35: THE ARBITRAGE-FREE VALUATION FRAMEWORK

EXAMPLE: Same date: based on the MODULE 35.2: BINOMIAL TREES, PART 2

table as we saw before for a 3-year,

3% annual-pay Treasury bond: Compute the value of the $100 face value option-free bond.

But we said, if this bond has embedded options changes in future

rates, S1, S2 and S3 will affect the probability of its exercise - and

hence, the underlying cash flows….

Hence we need a binomial interest rate tree framework to cope with

Why same? bond pricing of this nature.

Underlying interest

rate tree was

calibrated (using

lognormality) to

generate arbitrage-

free values

consistent with the

benchmark!