Page 28 - PowerPoint Presentation

P. 28

LOS 34.l: Explain how a bond’s exposure to each of the READING 34: THE TERM STRUCTURE AND

factors driving the yield curve can be measured and how these INTEREST RATE DYNAMICS

exposures can be used to manage yield curve risks.

MODULE 34.6: INTEREST RATE MODELS

Key Rate Duration

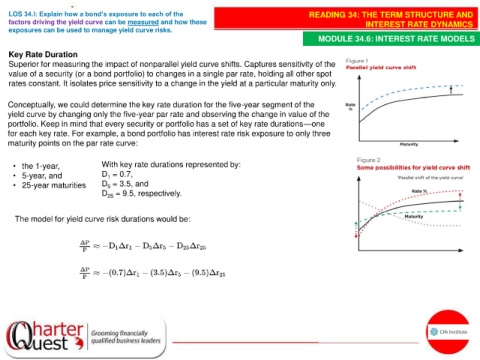

Superior for measuring the impact of nonparallel yield curve shifts. Captures sensitivity of the

value of a security (or a bond portfolio) to changes in a single par rate, holding all other spot

rates constant. It isolates price sensitivity to a change in the yield at a particular maturity only.

Conceptually, we could determine the key rate duration for the five-year segment of the

yield curve by changing only the five-year par rate and observing the change in value of the

portfolio. Keep in mind that every security or portfolio has a set of key rate durations—one

for each key rate. For example, a bond portfolio has interest rate risk exposure to only three

maturity points on the par rate curve:

• the 1-year, With key rate durations represented by:

• 5-year, and D = 0.7,

1

• 25-year maturities D = 3.5, and

5

D 25 = 9.5, respectively.

The model for yield curve risk durations would be: