Page 18 - PowerPoint Presentation

P. 18

READING 34: THE TERM STRUCTURE AND

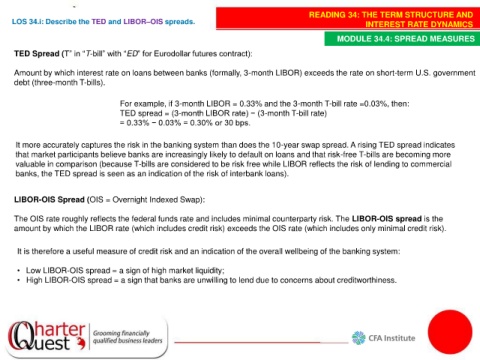

LOS 34.i: Describe the TED and LIBOR–OIS spreads. INTEREST RATE DYNAMICS

MODULE 34.4: SPREAD MEASURES

TED Spread (T” in “T-bill” with “ED” for Eurodollar futures contract):

Amount by which interest rate on loans between banks (formally, 3-month LIBOR) exceeds the rate on short-term U.S. government

debt (three-month T-bills).

For example, if 3-month LIBOR = 0.33% and the 3-month T-bill rate =0.03%, then:

TED spread = (3-month LIBOR rate) − (3-month T-bill rate)

= 0.33% − 0.03% = 0.30% or 30 bps.

It more accurately captures the risk in the banking system than does the 10-year swap spread. A rising TED spread indicates

that market participants believe banks are increasingly likely to default on loans and that risk-free T-bills are becoming more

valuable in comparison (because T-bills are considered to be risk free while LIBOR reflects the risk of lending to commercial

banks, the TED spread is seen as an indication of the risk of interbank loans).

LIBOR-OIS Spread (OIS = Overnight Indexed Swap):

The OIS rate roughly reflects the federal funds rate and includes minimal counterparty risk. The LIBOR-OIS spread is the

amount by which the LIBOR rate (which includes credit risk) exceeds the OIS rate (which includes only minimal credit risk).

It is therefore a useful measure of credit risk and an indication of the overall wellbeing of the banking system:

• Low LIBOR-OIS spread = a sign of high market liquidity;

• High LIBOR-OIS spread = a sign that banks are unwilling to lend due to concerns about creditworthiness.