Page 6 - PowerPoint Presentation

P. 6

LOS 34.b: Describe the forward pricing and forward

rate models and calculate forward and spot prices READING 34: THE TERM STRUCTURE AND

and rates using those models. INTEREST RATE DYNAMICS

MODULE 34.1: SPOT AND FORWARD RATES, PART 1

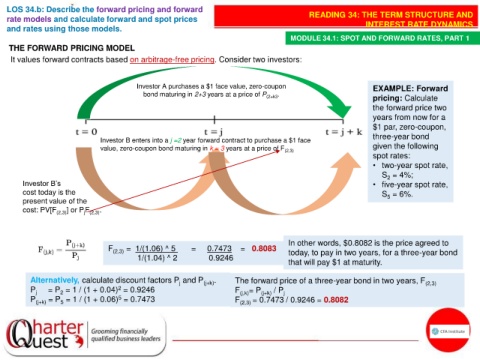

THE FORWARD PRICING MODEL

It values forward contracts based on arbitrage-free pricing. Consider two investors:

Investor A purchases a $1 face value, zero-coupon EXAMPLE: Forward

bond maturing in 2+3 years at a price of P (2+k3 . pricing: Calculate

the forward price two

years from now for a

$1 par, zero-coupon,

three-year bond

Investor B enters into a j =2 year forward contract to purchase a $1 face

value, zero-coupon bond maturing in k = 3 years at a price of F (2,3) given the following

spot rates:

• two-year spot rate,

S = 4%;

2

Investor B’s • five-year spot rate,

cost today is the S = 6%.

present value of the 5

cost: PV[F (2,3) ] or PF .

j (2,3)

In other words, $0.8082 is the price agreed to

F (2,3) = 1/(1.06) ^ 5 = 0.7473 = 0.8083 today, to pay in two years, for a three-year bond

1/(1.04) ^ 2 0.9246

that will pay $1 at maturity.

Alternatively, calculate discount factors P and P (j+k) . The forward price of a three-year bond in two years, F (2,3)

j

P j = P = 1 / (1 + 0.04) = 0.9246 F (j,k) = P (j+k) / P j

2

2

5

P (j+k) = P = 1 / (1 + 0.06) = 0.7473 F (2,3) = 0.7473 / 0.9246 = 0.8082

5