Page 5 - FINAL CFA SLIDES JUNE 2019 DAY 2

P. 5

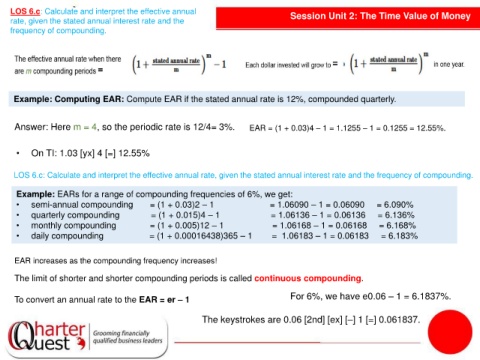

LOS 6.c: Calculate and interpret the effective annual Session Unit 2: The Time Value of Money

rate, given the stated annual interest rate and the

frequency of compounding.

Example: Computing EAR: Compute EAR if the stated annual rate is 12%, compounded quarterly.

Answer: Here m = 4, so the periodic rate is 12/4= 3%. EAR = (1 + 0.03)4 – 1 = 1.1255 – 1 = 0.1255 = 12.55%.

• On TI: 1.03 [yx] 4 [=] 12.55%

LOS 6.c: Calculate and interpret the effective annual rate, given the stated annual interest rate and the frequency of compounding.

Example: EARs for a range of compounding frequencies of 6%, we get:

• semi-annual compounding = (1 + 0.03)2 – 1 = 1.06090 – 1 = 0.06090 = 6.090%

• quarterly compounding = (1 + 0.015)4 – 1 = 1.06136 – 1 = 0.06136 = 6.136%

• monthly compounding = (1 + 0.005)12 – 1 = 1.06168 – 1 = 0.06168 = 6.168%

• daily compounding = (1 + 0.00016438)365 – 1 = 1.06183 – 1 = 0.06183 = 6.183%

EAR increases as the compounding frequency increases!

The limit of shorter and shorter compounding periods is called continuous compounding.

To convert an annual rate to the EAR = er – 1 For 6%, we have e0.06 – 1 = 6.1837%.

The keystrokes are 0.06 [2nd] [ex] [–] 1 [=] 0.061837.