Page 6 - FINAL CFA SLIDES JUNE 2019 DAY 2

P. 6

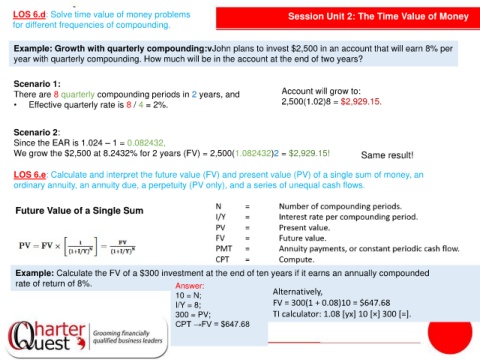

LOS 6.d: Solve time value of money problems Session Unit 2: The Time Value of Money

for different frequencies of compounding.

Example: Growth with quarterly compounding:vJohn plans to invest $2,500 in an account that will earn 8% per

year with quarterly compounding. How much will be in the account at the end of two years?

Scenario 1:

There are 8 quarterly compounding periods in 2 years, and Account will grow to:

• Effective quarterly rate is 8 / 4 = 2%. 2,500(1.02)8 = $2,929.15.

Scenario 2:

Since the EAR is 1.024 – 1 = 0.082432,

We grow the $2,500 at 8.2432% for 2 years (FV) = 2,500(1.082432)2 = $2,929.15! Same result!

LOS 6.e: Calculate and interpret the future value (FV) and present value (PV) of a single sum of money, an

ordinary annuity, an annuity due, a perpetuity (PV only), and a series of unequal cash flows.

Future Value of a Single Sum

Example: Calculate the FV of a $300 investment at the end of ten years if it earns an annually compounded

rate of return of 8%. Answer:

10 = N; Alternatively,

I/Y = 8; FV = 300(1 + 0.08)10 = $647.68

300 = PV; TI calculator: 1.08 [yx] 10 [×] 300 [=].

CPT →FV = $647.68