Page 43 - FINAL CFA I SLIDES JUNE 2019 DAY 3

P. 43

Session Unit 3:

LOS 10.g: Construct a binomial tree to describe

stock price movement, p.220 10. Common Probability Distributions

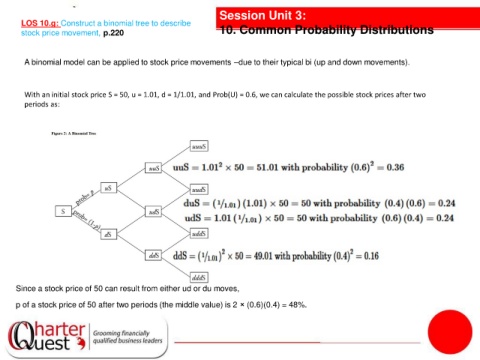

A binomial model can be applied to stock price movements –due to their typical bi (up and down movements).

With an initial stock price S = 50, u = 1.01, d = 1/1.01, and Prob(U) = 0.6, we can calculate the possible stock prices after two

periods as:

Since a stock price of 50 can result from either ud or du moves,

p of a stock price of 50 after two periods (the middle value) is 2 × (0.6)(0.4) = 48%.