Page 11 - Capital Allowances Recoupments Part 3 (CTA)

P. 11

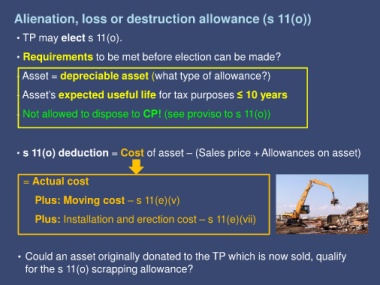

Alienation, loss or destruction allowance (s 11(o))

• TP may elect s 11(o).

• Requirements to be met before election can be made?

- Asset = depreciable asset (what type of allowance?)

- Asset’s expected useful life for tax purposes ≤ 10 years

- Not allowed to dispose to CP! (see proviso to s 11(o))

• s 11(o) deduction = Cost of asset – (Sales price +Allowances on asset)

= Actual cost

Plus: Moving cost – s 11(e)(v)

Plus: Installation and erection cost – s 11(e)(vii)

• Could an asset originally donated to the TP which is now sold, qualify

for the s 11(o) scrapping allowance?