Page 16 - Capital Allowances Recoupments Part 3 (CTA)

P. 16

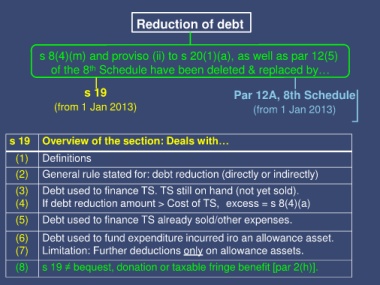

Reduction of debt

s 8(4)(m) and proviso (ii) to s 20(1)(a), as well as par 12(5)

of the 8 Schedule have been deleted & replaced by…

th

s 19 Par 12A, 8th Schedule

(from 1 Jan 2013) (from 1 Jan 2013)

s 19 Overview of the section: Deals with…

(1) Definitions

(2) General rule stated for: debt reduction (directly or indirectly)

(3) Debt used to finance TS. TS still on hand (not yet sold).

(4) If debt reduction amount > Cost of TS, excess = s 8(4)(a)

(5) Debt used to finance TS already sold/other expenses.

(6) Debt used to fund expenditure incurred iro an allowance asset.

(7) Limitation: Further deductions only on allowance assets.

(8) s 19 ≠ bequest, donation or taxable fringe benefit [par 2(h)].